The MarketSmith Hong Kong 25.5.0 version has been fully upgraded, bringing optimizations to the shareholder module within individual stock information tabs for investors. This update introduces a ” Statistics” tab, helping investors gain deeper insights into company ownership structures and thereby enhancing the precision of investment decisions.

Ownership structure analysis plays a crucial role in investment decision-making, especially when evaluating a company’s stability and future growth potential. This new feature allows investors to more easily access data on institutional investor and corporate executive holdings, thus identifying significant factors that may impact stock prices.

Core Optimizations of the Ownership Module

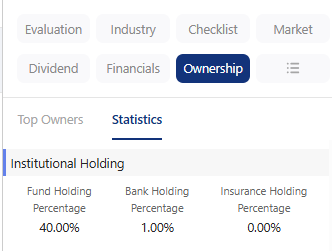

Upon entering an individual stock information interface, users can find the “Statistics” tab under the shareholder module. The page unfolds around three core dimensions:

1. Institutional Holding: Clearly displays the shareholding ratios of institutional investors such as funds, banks, insurance companies

This data helps investors understand different institutions’ investment preferences, thereby uncovering potential investment opportunities. Significant changes in institutional holding may signal shifts in market sentiment towards the company. For instance, if institutional investors continuously increase their holdings in a particular stock, it might indicate that the company’s fundamentals are solid and recognized by the market. Conversely, a noticeable decline in institutional holdings could suggest weakened market confidence, prompting investors to further analyze the reasons behind it.

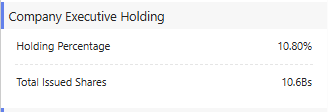

2. Company Executive Holding: Provides information on the ownership ratio of senior management and compares it with the company’s total issued shares

The level of ownership by management usually reflects their confidence in the company’s long-term development. When executives significantly increase their holdings, it may imply optimism about the company’s future performance. Executive increases are generally seen as positive signals, while large-scale decreases may raise market concerns. Therefore, combining this data with technical and fundamental analyses, investors can use it as an important reference for making investment decisions.

3. Fund Holding Overview: Tracks fund holding data and shows trends in quarterly holdings

Changes in fund ownership trends help grasp shifts in market sentiment. If funds continually increase their holdings in a company, it may indicate widespread optimism about its growth potential. On the other hand, substantial reductions by funds may signal potential risks. Investors can use this to determine whether funds are continuously increasing or decreasing their holdings in a stock, assessing the potential impact of capital flow trends.

Enhancing Investment Analysis with Ownership Statistics

MarketSmith Hong Kong is dedicated to enhancing the analytical experience for investors. Through this optimized ownership module, investors can intuitively and efficiently interpret ownership data, leading to more precise investment strategies. We welcome users to experience this new feature and make full use of ownership statistics data according to their own investment logic to seize market opportunities.

If you have any questions or suggestions regarding this feature, please feel free to contact us. We look forward to your feedback!