When investing in stocks, understanding the industry situation of individual stocks is crucial. Market trends are often driven by industries, and a stock’s ranking within its industry can determine whether it’s worth investing in. Therefore, in the MarketSmith Hong Kong 25.5.0 version, we have optimized the industry module within the stock interface to make it more intuitive and comprehensive, providing investors with richer industry information.

Core Optimizations of the Industry Module

After this update, the industry module has been divided into three sub-sections: Basic Information, Industry Overview, and Stock Rankings, helping users quickly grasp industry dynamics from different angles.

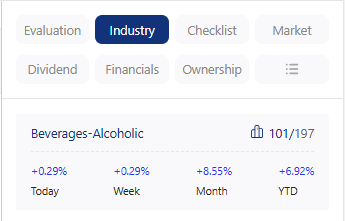

1. Basic Information: Intuitive Presentation of Industry Ranking and Fluctuations

Basic industry information is now clearer, including the industry name (clickable to enter the industry homepage), O’Neil industry rankings, and fluctuation data across multiple time frames. Industry rankings help users understand how an industry performs in the market; the higher-ranked industries tend to show stronger market trends. Meanwhile, the fluctuation data for the day, week, month, and year provide investors with an intuitive technical analysis.

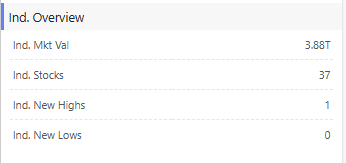

2. Industry Overview: Understanding Industry Strength from a Macro Perspective

To enable investors to comprehensively grasp industry dynamics, we’ve added an “Ind. Overview” feature. This section provides the total market value and number of stocks in the industry, helping users gauge the overall scale of the industry. Additionally, it includes two key metrics: “Ind. New Highs” and “Ind. New Lows.” An industry with a high number of new highs indicates active technical performance, whereas a high number of new lows may suggest the industry is in a downturn, requiring caution from investors.

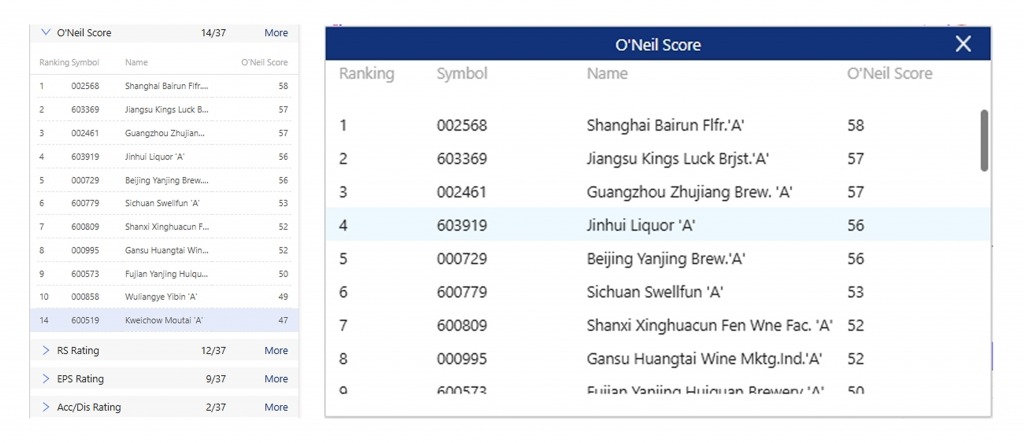

3. Stock Rankings: Measuring Stock Performance Across Four Scoring Dimensions

The performance of individual stocks within their industry is equally important. Therefore, we offer four dimensions for scoring within the industry: O’Neil Score, RS Rating, EPS Rating, and Acc/Dis Rating. Investors can use these scores to quickly filter out the strongest performing stocks in the industry and select those with greater investment potential.

Each scoring dimension supports expanding to view the top 10 ranked stocks and displays the current stock’s position within the industry. If a particular stock does not rank in the top 10, it will be appended to the list to ensure investors can quickly ascertain its standing. Moreover, users can click on the “More” button to obtain all the scores and rankings of stocks within the industry.

Making Investment Decisions More Accurate

Through the optimization of the industry module, MarketSmith Hong Kong enables investors to more easily keep abreast of industry dynamics, from industry performance, market trends, to stock rankings, all under control. This not only enhances the efficiency of investment decisions but also makes technical analysis simpler and more intuitive.

We look forward to your feedback! Should you have any questions or suggestions, please feel free to contact us to collectively enhance your investment experience.