The method that powers MarketSmith Hong Kong, perfected over 50 years, is outlined in detail in the best-selling book, How to Make Money in Stocks, but learning and following just three basic principles of our method can help you improve your investing success right away.

Follow the lead of large institutions

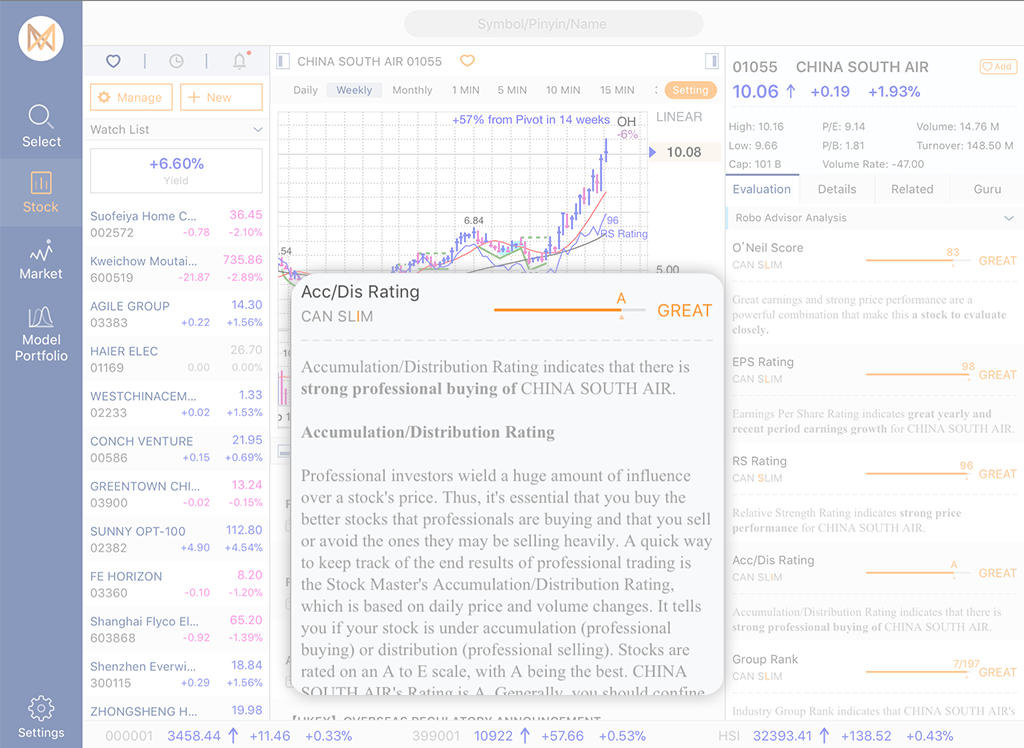

When the number of large money-management institutions owning an equity is steadily increasing, you have added confirmation that the equity is being supported by those who move the market. In short, you’ll want to buy stocks that large institutions are buying, something our app can tell you via the Accumulation/Distribution Rating (Buyer Demand).

Based on a formula that analyzes daily price and volume changes, it tracks the relative degree of institutional buying (accumulation) and selling (distribution) in a particular stock over the last 13 weeks. Stocks with an A or A+ rating are experiencing heavy institutional buying, while stocks with an E rating are experiencing heavy institutional selling. (For more on how to identify strong investments, see CAN SLIM section.)

Buy and sell in step with the overall market

It sounds simple, yet many investors buy and sell stocks without being sure of the overall direction of the market. Be sure the market is in an uptrend before buying, and when the market is headed for a downturn—we can teach you the signs—lighten up your holdings and go to cash. Once the overall market is in a downturn, stay in cash until it improves.

Lock in gains using a strict sell discipline

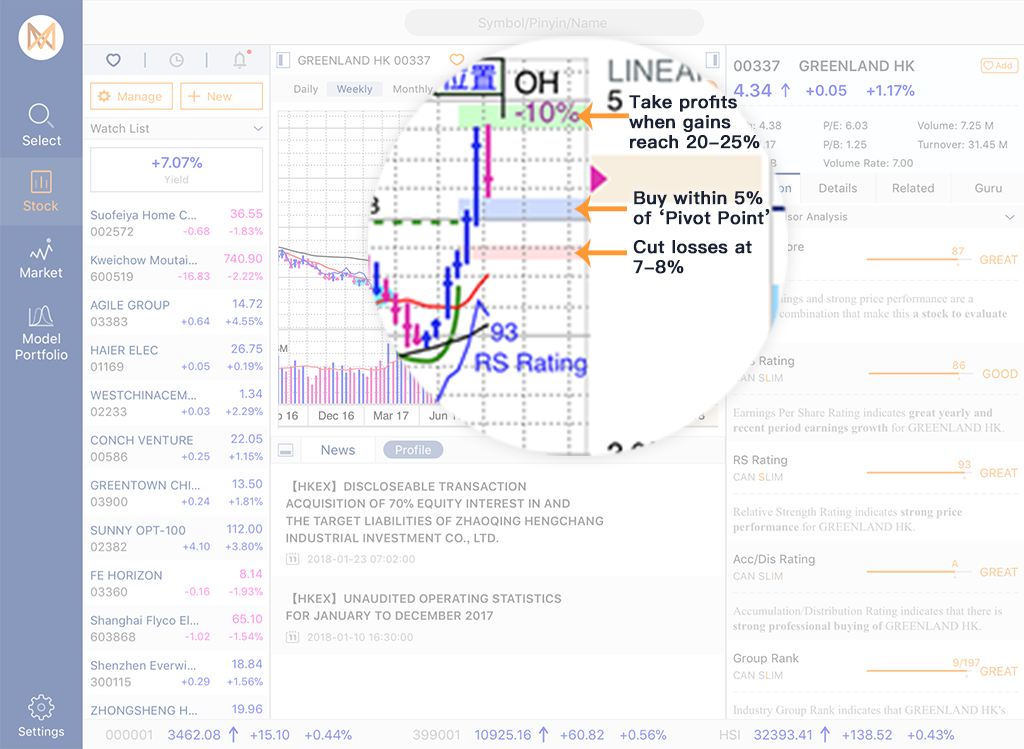

It is better to sell stocks too early than too late. Never let a position drop lower than 7-8% below the price at which you bought it. When this happens, sell it and invest in an equity that is rising in price.

You will also want to take some of your profits when an equity you own is up 20%-25% in price. Most equities correct near that point, and that way you lock in profits. The exception is when a stock has risen 20% in just one to three weeks and is still in demand by large institutions. In that case, it could be a big leader that should be held until other sell signs appear.

People tend to buy stocks they like, stocks they feel good about, or stocks they feel comfortable with, but in an otherwise exciting stock market, these sentimental securities often lag the market rather than lead it. Don’t just dabble in stocks. Dig in, do some detective work and find out what really works.

—William J. O’Neil, How to Make Money in Stocks